Africa’s role in the global economy has been steadily growing over the past few years, with the continent home to some of the fastest-growing economies in the world. Trade finance plays a crucial role in facilitating cross-border transactions and supporting economic growth. However, businesses in Africa continue to face significant challenges in accessing trade finance, leading to an estimated $81 billion trade finance gap according to Africa Development Bank estimates..

The African Continental Free Trade Area (AfCFTA) presents an opportunity to address these challenges and improve access to trade finance in Africa.

This article will explore the current state of trade finance in Africa, the challenges faced by African businesses, the anticipated role of AfCFTA in addressing these challenges, and the importance of collaboration among governments, financial institutions, and the private sector.

The current state of trade finance in Africa

Trade finance is essential for facilitating international trade by providing the necessary financial instruments and services to businesses. In Africa, the demand for trade finance has been growing in line with the expansion of intra-African and international trade.

However, the supply of trade finance has not kept pace with demand, resulting in a significant gap. This gap disproportionately affects small and medium-sized enterprises (SMEs – the economic engine room of Africa), which often struggle to access the credit and financial services they need to participate in global trade.

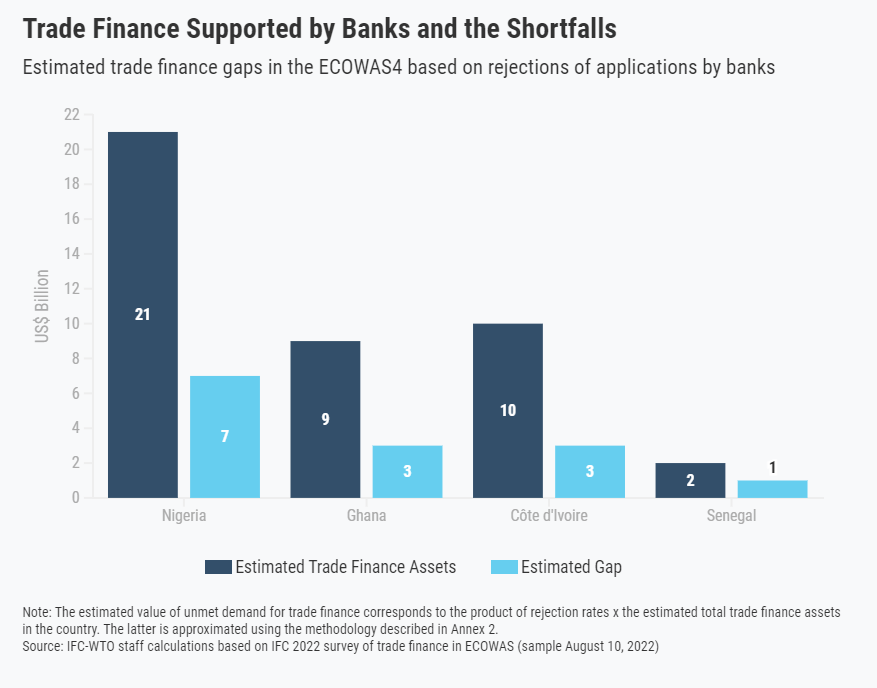

Trade finance gaps in Africa vary across countries due to factors such as differences in economic development, financial infrastructure, and regulatory environments. The chart below shows trade finance gaps across key economies in the Western African Market.

Challenges faced by African businesses in accessing trade finance.

Trade finance gap has been a bane to African businesses with the negative consequence of stifled growth and collapse of businesses as a result. Several challenges contribute to the trade finance gap in Africa. These include:

- Limited access to credit: Many African businesses, particularly SMEs, lack the collateral and credit history required to secure loans from traditional financial institutions. As a result, they are often unable to access the necessary financing to participate in trade.

- High transaction costs: The costs associated with accessing trade finance can be prohibitive for African businesses, especially in regions with underdeveloped financial infrastructure and regulatory environments.

- Lack of information and awareness: Many African businesses are not aware of the various trade finance options available to them, limiting their ability to access these services.

- Macroeconomic factors: Unstable political and economic environments in some African countries can deter investors and financial institutions from providing capital to businesses. High inflation rates, political instability, and weak economic growth can all contribute to a challenging business environment, making it difficult for businesses to access capital.

- Currency risk: Businesses in Africa often face currency risks when dealing with international transactions or borrowing in foreign currencies. Fluctuations in exchange rates can make it difficult for businesses to predict their cash flows and plan their investments, which can limit their access to capital.

Opportunities presented by AfCFTA

The African Continental Free Trade Area (AfCFTA) presents a significant opportunity for addressing the trade finance gaps in Africa. The AfCFTA is a landmark trade agreement that seeks to create a single market for goods and services across the African continent. It covers 54 African countries with a combined population of over 1.2 billion people and a combined GDP of over $3 trillion.

The AfCFTA presents an opportunity to address these trade finance gaps by creating a more integrated and interconnected African market. By eliminating trade barriers and promoting trade liberalization, the AfCFTA can facilitate greater trade flows, which can in turn increase demand for trade finance.

Several African countries are already taking steps to leverage the opportunities presented by the AfCFTA to address trade finance gaps. For example, Nigeria has established a $1 billion trade and investment facilitation initiative to support Nigerian exporters and importers. The initiative provides funding for trade finance, credit guarantees, and other financial products and services.

In Kenya, the government has launched a digital platform called the Kenya Electronic Single Window System for Trade, which aims to simplify trade processes and reduce the time and cost of doing business. The platform includes a trade finance module that provides a range of financial products and services to support trade, including invoice financing, factoring, and trade credit insurance.

Overall, the AfCFTA presents a significant opportunity to address the trade finance gaps in Africa. By promoting greater trade flows and creating a more integrated African market, the AfCFTA can increase demand for trade finance and help SMEs access the finance they need to participate in trade. Several African countries are already taking steps to leverage the opportunities presented by the AfCFTA, and more are likely to follow in the coming years.

The role of AfCFTA in addressing trade finance challenges

The AfCFTA, which came into force in January 2021, aims to create a single market for goods and services in Africa, ultimately boosting intra-African trade and economic growth. By removing tariffs and other trade barriers, the AfCFTA is expected to increase the demand for trade finance across the continent. The agreement also includes provisions that aim to improve access to trade finance for African businesses by:

- Promoting the harmonization of trade finance regulations and standards across member countries, which could lower transaction costs and facilitate access to financing.

- Encouraging the development of regional financial institutions and the integration of African capital markets, which could improve the availability of trade finance in the region.

- Fostering cooperation between governments, financial institutions, and the private sector to address the challenges faced by African businesses in accessing trade finance.

The importance of collaboration in realizing the AfCFTA’s potential for trade finance in Africa

To bridge the trade finance gap in Africa and fully realize the potential of the AfCFTA, collaboration among governments, financial institutions, and the private sector is crucial. This collaboration can take several forms:

- Developing innovative financial products and services tailored to the needs of African businesses, particularly SMEs.

- Establishing public-private partnerships to provide credit guarantees and risk-sharing facilities, which could encourage financial institutions to extend trade finance to more businesses.

- Promoting financial inclusion and digitalization to increase access to credit and financial services for businesses in rural and under-served areas.

- Providing training and capacity-building programs to help businesses better understand and navigate the trade finance landscape.

Conclusion

The AfCFTA presents a unique opportunity to address the trade finance gap in Africa and unleash the continent’s full economic potential. By fostering greater collaboration among governments, financial institutions, and the private sector, the AfCFTA can help create an enabling environment for businesses to access the credit and financial services they need to participate in regional and global trade.

Overcoming the challenges faced by African businesses in accessing trade finance will not only enhance the competitiveness of the continent’s enterprises but also support job creation, poverty reduction, and sustainable economic growth.

As the AfCFTA continues to gain momentum, it is crucial for all stakeholders to work together to bridge the trade finance gap and unlock the opportunities that the agreement presents for Africa’s future.